by Brianna Crandall — June 26, 2015—For facilities managers wondering where their data center expenditures will be heading in the next couple years, research firm IHS conducted in-depth surveys with 150 businesses in North America about their data centers and found that 45 percent intend to increase spending on software-defined wide area networking (SD-WAN) over the next two years.

“Within the data center, raw speed with support for software-defined networking (SDN) and virtualized workloads are the top requirements for fabrics among companies participating in our enterprise data center study,” said Cliff Grossner, PhD, research director for data center, cloud and SDN IHS.

“Meanwhile, outside the data center, SDN-led transformation is taking hold in the WAN optimization market. There’s a shift from optimizing application traffic flows over a single point-to-point WAN link to automated and dynamic load balancing of application traffic over multiple link types—MPLS, broadband, Internet, cellular, et cetera,” Grossner said.

Data center strategies survey highlights:

- Security, application performance and scalability are respondent organizations’ top data center investment drivers.

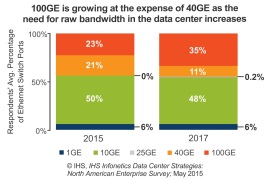

- The need for raw bandwidth continues to drive higher speeds in data center networking: Among enterprises surveyed, 100GE deployments are growing at the expense of 40GE, and 25GE is nearly invisible.

- The use of solid state drives for storage is increasing and placing higher performance demands on storage networking.

- By 2017, 71 percent of respondents plan to have software-defined storage products in live production, up from 15 percent today.

For the 31-page IHS Infonetics Data Center Strategies: North American Enterprise Survey, IHS interviewed purchase-decision makers at North American medium and large organizations about their plans for data center hardware, management software and cloud services over the next two years. Survey participants were asked about data center spending plans, investment drivers, sites, physical servers, virtualization, switch ports, Ethernet and storage technologies, and vendors.

To purchase the report, contact Infonetics.