January 27, 2021 — The pandemic-induced downturn that some feared would severely impact the flexible office space sector has instead landed flex space a prime role in future office strategies, according to a new report from global commercial real estate services and investment firm CBRE Group.

The company’s annual flex-office report outlines how the once-surging sector has held its own amid pandemic-related lockdowns and the resulting recession. Though the sector’s annual growth in square footage slowed to 7% as of the second quarter from 41% in the prior year, closures have been fewer than anticipated.

The outlook for flex office now is optimistic: A recent CBRE survey of 77 major companies across the globe found that 86% anticipate using flex space as a key part of their real estate strategies going forward. Additionally, 82% said they will favor buildings that include flex-space offerings.

According to Julie Whelan, CBRE global head of Occupier Research:

This downturn has sparked flex office to become a strong alternative to traditional leases for many office-using companies. That is in large part because flex space can provide companies the agility to accommodate a workforce that values more choice over where and how they work.

Additionally, the flex-office sector is growing increasingly resilient as more landlords operate their own flex space or form partnerships with flex operators for portions of their buildings. Overall, this has created a more stable foundation for the sector’s continued growth.

CBRE defines flexible office space to include multiple formats of office space leased for shorter-than-traditional terms. That includes coworking, which often entails communal desks and common areas used by a flex operator’s occupants. But it also includes faster-growing models, such as private suites and enterprise offerings, that dedicate offices or entire floors for use by individual companies.

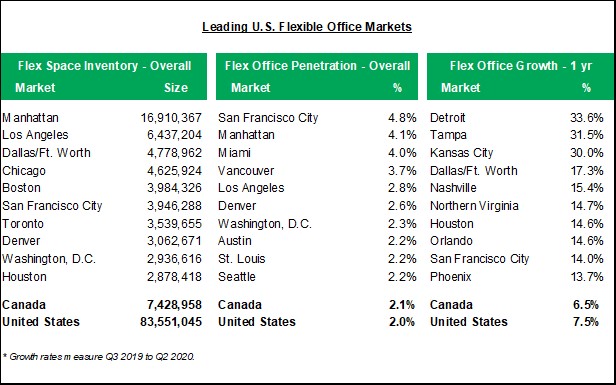

Geographically, the flex sector is most established in gateway and coastal markets, led by Manhattan. However, the fastest-growing flex markets of the past year include many Midwestern and Southern cities.

CBRE details multiple factors supporting the flexible office space sector’s resiliency andcontinued growth:

- Demand is anticipated at healthy levels, as shown by responses in CBRE’s surveys of companies about incorporating flex space into their plans. Once those companies shift back into growth mode, flex space will offer them a nimble tool for expansion. It can also provide flexibility for individual employees through new subscription and on-demand formats that allow them to reserve workspace anywhere within a provider’s network on short notice.

- The recession and pandemic spurred flex operators and their landlords to better cooperate to ensure the operators can survive and later thrive, sometimes through revised lease terms. That also has led to more momentum for flex-space models in which the landlord takes a greater role, either by partnering with the operator and sharing profits and losses, or by the landlord operating the flex space itself.

- Supply growth has slowed, and various operators are fine-tuning their portfolios, which likely will help the industry avoid a glut of unused space as demand has slowed.

Christelle Bron, CBRE Americas Agile Practice leader, pointed out:

There are enough different models and formats of flex space today to fit the needs of nearly any user, but the biggest driver of the sector’s growth will be larger enterprise users. The downturn has streamlined and solidified the flex sector, and that will allow the flex industry to mature into a cornerstone of the broader office market.

To download the full The End of the Beginning: North America Flexible Office Market in 2020 report, visit the CBRE website.

Dallas-based Fortune 500 and S&P 500 company CBRE offers a broad range of integrated services including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services through more than 530 offices and 100,000 employees (excluding affiliates) worldwide.