Posted by Johann Nacario — April 15, 2024 — People taking care of other people is at the core of healthcare, and real estate provides safe and healthy spaces for providers and systems to keep communities thriving. How and where people get their healthcare now is changing. Driven by technology, reimbursement challenges and consumer preferences, healthcare continues to shift to outpatient sites. Even the terminology used for “medical office” is moving toward something more comprehensive: medical outpatient building (MOB). The new U.S. Medical Outpatient Building Perspective from global real estate and professional services firm JLL provides a lens into these transformations occurring in the industry.

Alison Flynn Gaffney, FACHE, President, Healthcare Division, JLL said:

Alison Flynn Gaffney, FACHE, President, Healthcare Division, JLL said:

Today, a surgery center or lab services may be in a hospital, office building or even a retail center. As patient care continues to grow beyond the traditional locales to outpatient sites closer to where patients live and work, seeking healthcare becomes more accessible. Occupiers and owners must take these shifting preferences and changing demographics into account when looking at opportunities.

The report also discusses factors driving demand for medical office and outpatient properties, real estate fundamentals, how rising construction costs affect the industry, where the growth markets – and opportunities – are and the attractiveness of the sector to investors.

What’s driving demand?

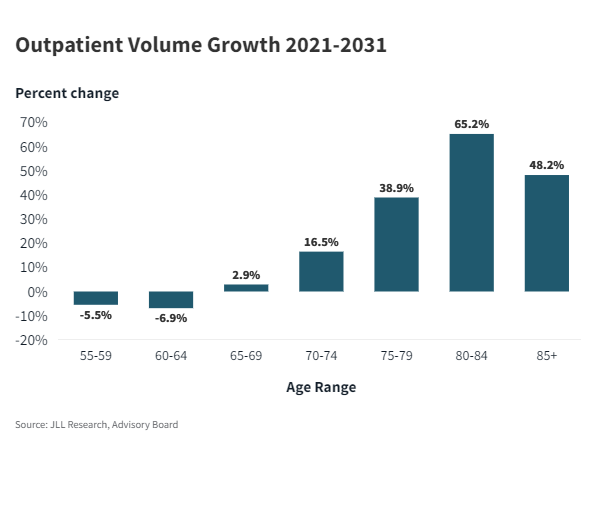

Demographic trends, consumer preferences, technology and reimbursement changes are continuing to steer the shift toward outpatient care, in turn driving demand for medical outpatient buildings. An aging population requires more care. In fact, the 80+ population is expected to grow by 50% within the next decade, and older populations will drive rapid outpatient volume growth, with patients aged 80 to 84 expected to see about a 65% increase in outpatient volumes.

Additionally, growing specialties are taking center stage and focusing on lifelong health and wellness. Endocrinology is the fastest-growing specialty due to the popularity of GLP-1 receptor agonists as a treatment for both diabetes and obesity. Additionally, patients are living longer, more active lives. Between 2022 and 2023, Definitive Healthcare Commercial Claims Database reports a nearly 20% increase in commercial claims for total hip, knee and shoulder replacements, and more outpatient surgeries for joint replacements will result in higher demand for rehabilitation services, the second-fastest category behind endocrinology.

Technological advancements like early detection and less invasive care options are also shifting oncology services out of the hospital and into outpatient settings by dispersing smaller cancer care centers closer to patients in neighborhood hospitals or tied to an ambulatory surgery center.

Jay Johnson, U.S. practice leader, Healthcare Markets, JLL, noted:

The movement of more treatment options to outpatient sites is about more than convenience. It’s about providing better access to care, and the shift to outpatient sites drives down overall costs and, ultimately, improves outcomes for patients. These positive dynamics are likewise driving investor interest in medical properties and beating other real estate investment sectors.

Improving fundamentals

Even though on-campus MOBs typically lead off-campus properties in occupancy, off-campus MOBs saw a greater increase in occupancy from 2019 to 2023, with off-campus occupancy increasing 1.9% and on-campus 1%.

Johnson added:

We believe the shift toward outpatient care will continue to increase demand both for on- and off-campus medical outpatient buildings. To capture revenue moving out of inpatient care, health systems will expand outpatient services, sometimes moving care right across the street to a MOB and outpatient surgery center in the same building.

Additionally, where occupancy for traditional offices has declined since 2020, MOBs have seen the opposite. Net absorption for 2023 stood at 16.9 million square feet, and, while slightly slower than annual totals in 2021 and 2022, the pace of demand still exceeds pre-pandemic levels. Additionally, MOB rent outpaced office rent growth 4% to 2% from Q4 2022 to Q4 2023.

Construction challenges

Healthcare organizations face thin margins as they focus on optimizing patient care. With real estate comprising 8 to 12% of health systems’ budgets — and labor costs rising — they must look for other areas for cost savings. Overall, construction costs are expected to increase 2% to 4% in 2024, and ongoing skilled labor shortages continue to put pressure on prices and timelines.

Andrew Quirk, Institutional Industries lead, Project and Development Service, JLL, remarked:

Health systems and providers can minimize out-of-pocket costs tied to leasing new office space by evaluating their current space and renovating it to cater to their specific needs. By incorporating innovative methods, technology and processes, the construction phase can become more efficient for healthcare users and developers, enabling them to achieve more with fewer resources.

Market and population growth

Sunbelt markets like Austin, Orlando, Raleigh Durham and Nashville have high population and employment growth, which is driving healthcare expansion. Additionally, the Dallas-Fort Worth area will see the largest volume growth in numerical terms, Austin will see the fastest expansion with a 23.1% growth rate.

New York has the largest amount of medical office space under construction to support its 19 million people, but Houston comes in a close second with 1.4 million square feet under construction to support its growing prominence in healthcare and life sciences.

Kari Beets, senior manager, Healthcare Research, JLL, pointed out:

Even as population growth is a major driver of new medical office construction, the density and layout of a metro area also factors into construction. Patients value proximity and convenience. Like retail, MOB construction follows population growth, causing older MOBs in areas with less population growth to sometimes fall out of favor, and health systems to pivot locations to serve their patients.

Opportunity ahead for investors

The sharp rise in interest rates in 2023 led to uncertainty, but properties with long remaining lease terms and facilities aligned with well-performing health systems are transacting with multiple offers and less well-positioned assets are not trading or trading at a discount. The Los Angeles metro led the nation in MOB sales with $571 million transacting followed by the Washington, D.C., metro area with $486 billion.

Now that interest rates appear to have peaked, and as conditions stabilize or rates fall, sellers that put marketing processes on hold in 2022 and 2023 will explore taking these to market in 2024.

Andrew Milne, senior managing director, Medical Properties Group co-lead, JLL Capital Markets, concluded:

We are seeing a narrowing bid-ask gap between sellers and buyers generally with pent-up demand from investors to place capital into higher-quality assets, which have been in limited supply. There are more motivated sellers today especially with loans originated in 2019 to 2021 beginning to mature or requiring interest-rate hedges at significantly higher costs than originally underwritten.

The U.S. Medical Outpatient Building Perspective is available from JLL.

JLL Healthcare provides a full range of real estate and facilities solutions for hospitals, physicians and other care providers as well as real estate investors that own and operate medical and seniors housing properties. The company helps its healthcare clients plan, find, finance, buy, lease, sell, construct, optimize, manage and maintain the most-advantageous facilities anywhere in the U.S. for all property types along the continuum of care, serving over 550 million square feet of healthcare property annually. Its professionals have deep technical expertise and market knowledge and are armed with the most innovative, data-driven analytics and business intelligence in the industry.