Posted by Johann Nacario — May 3, 2023 — Global commercial real estate services and investment firm CBRE’s new Facilities Management Procurement Perspectives report, a study focused solely on facilities management (FM) procurement, has revealed that organizational delivery; supply chain inflation; and environmental, social and governance (ESG) imperatives are the three key drivers shaping FM procurement strategies.

The survey canvassed 40 corporations from across eight sectors including Life Sciences, Industrial & Logistics and Financial & Professional Services. Its findings show that outsourcing has become the dominant real estate delivery model, with 58% of respondents stating that they outsource (strategic alliances with third party providers) FM services while a quarter out-task (use of firms for tactical roles such as janitorial, engineering, etc.) and the remaining 15% self-perform in-house.

Bob Bruning, chief procurement officer, CBRE, pointed out:

Outsourcing has gained popularity across many areas of business over the years, particularly following the pandemic, which saw corporations rapidly adjust their supply chain delivery models. Outsourcing providers gain greater access to a broader variety of innovations and benefit from supply chain efficiencies through consolidating significant spend. They also can better leverage their buying power and supplier relationships.

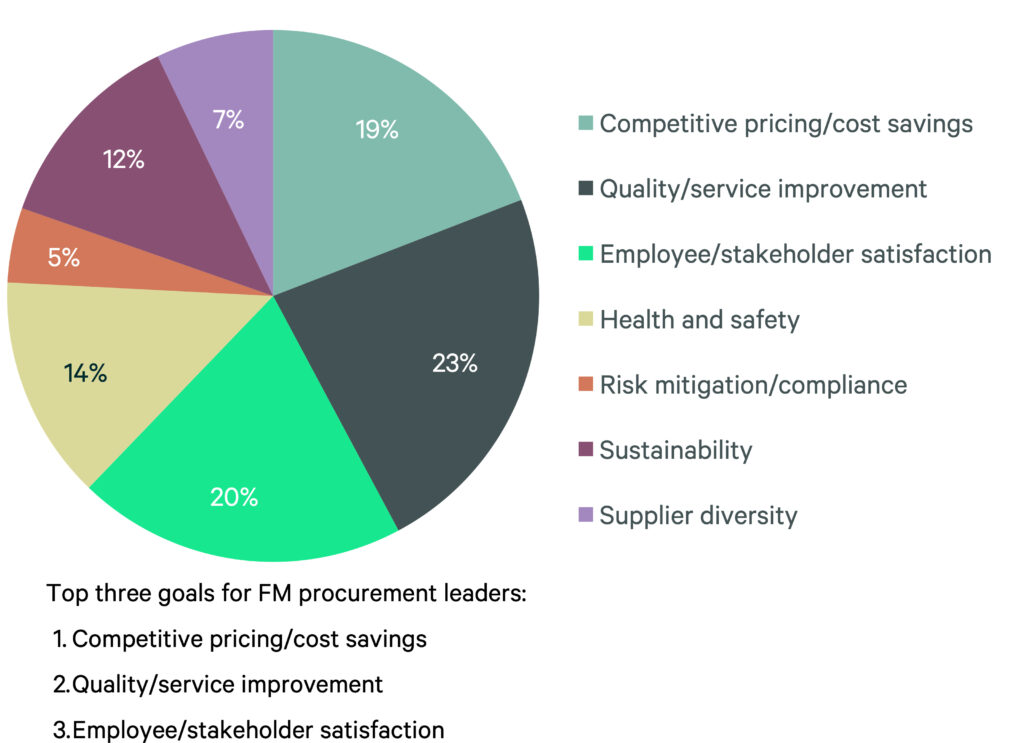

Goals that FM procurement leaders called their “top priority”. Graphic courtesy of CBRE. Click to enlarge.

According to CBRE’s findings, supply chain inflation is top of mind for procurement teams, with 70% of respondents stating that inflationary pressure is having a high impact on their FM supply chain. Despite the impact, 75% of respondents feel confident that they can identify and mitigate the risks. More than 90% are using competitive sourcing or direct negotiation strategies to reduce costs.

The global pandemic, steep energy costs, and labor and material shortages have shown just how volatile global supply chain can be, and as a result, procurement teams are facing considerable cost challenges. Currently, 77% of work order delays are attributed to unavailable materials. Organizations often use a wide variety of strategies to manage pricing pressures such as competitive sourcing, service level optimization and smart contracting.

CBRE’s report shows that ESG criteria are fast becoming a procurement imperative as organizations work under pressure to achieve decarbonization targets. Approximately 72% of companies surveyed have defined sustainability commitments, while 88% of respondents use scorecards with key performance indicators (KPI’s) to hold suppliers accountable for their ESG performance.

As ESG commitments continue to rise on the corporate agenda, CBRE has identified three trends driving increased commitment to sustainability. Those include:

- Employees who expect employers to be sustainable;

- Tightening regulations and reporting requirements; and

- Investors that seek to safeguard their returns.

Survey respondents reported that they suspect that their real estate portfolio and related facilities management operations are major contributing factors to their company’s emissions. Going forward, organizations anticipate building supply chains that can withstand climate-related challenges, setting ambitious sustainability targets, effectively tracking and measuring results, and ensuring that leadership is investing in the ESG agenda.

Diversity, equity, and inclusion (DE&I) is also a growing ESG focus area for companies, with the most common supplier diversity spend target in the 5-10% range. CBRE’s report shows that most respondents rated their progress on supplier diversity positively with 56% monitoring the rate of inclusion in RFX (Request for X) events.

Bruning further remarked:

We are seeing many organizations expand their diversity goals each year to provide a new baseline for achieving and exceeding supplier diversity targets. As the supply chain environment continues to evolve, companies may have to increase investments or pay a premium to achieve their diversity objectives.

To read the full Facilities Management Procurement Perspectives report, visit CBRE.