This article originally appeared in the July/August 2021 issue of FMJ

In April 2021 the Paris-based International Energy Agency (IEA) issued its 2021 Global Energy Review with a focus on assessing the effects of economic recoveries on global energy demand and CO2 in 2021. The Review also included negative predictions related to the current state of climate management. In summary:

- Global energy demand is set to increase by 4.6 percent in 2021, more than offsetting the 4 percent contraction in 2020 and pushing demand 0.5 percent above 2019 levels;

- Electricity demand is heading for its fastest growth in more than 10 years with a projected increase of 4.5 percent in 2021 (equivalent to more than 1,000 Terra-Watt hours). This is almost five times greater than the decline experienced in 2020;

- Global energy-related CO2 emissions are heading toward their second-largest annual increase ever;

- Energy-related emissions are expected to finish the year just below where they stood in 2019, reversing 80 percent of the decline seen during the pandemic year of 2020;

- At the same time, the IEA is predicting some good news. Renewables are set to provide more than half the increase in global electricity supply for 2021. However, it is also predicted that the demand for coal is expected to rise by 4.8 percent in 2021 to meet the same projected growth in the use of electricity.

The COVID-19 pandemic has upended lives and economies. While greenhouse gas emissions have decreased and air quality has improved during this time, more sustainable production and consumption changes are needed. To maintain these climate-related improvements as businesses rebound, every aspect of the world economy will have to get involved, making a coordinated, multifaceted effort toward reducing global carbon emissions by combining common sense with state-of-the-art technologies. A number of strategies are required for these efforts to be successful:

- Leadership skills

- Corporate commitment

- Sustainable green financing

- Focus on high-impact sectors

- Partnership between cities and buildings owners

- Improvement of the energy grid

- Research and technology optimization

1) Leadership Skills

Visible and committed leadership is critical. Examples include:

- The U.S. rejoining the Paris Agreement on Climate Change and the presidential administration’s commitment to supporting climate change management;

- Business leaders’ advocacy, such as can be found in Bill Gates recent book “How to Avoid a Climate Disaster: The Solutions We Have and the Breakthroughs We Need;”

- Environmental activist initiatives such as those by Greta Thunberg in Sweden. Her book “No One is Too Small to Make a Difference” is well-worth reading;

- Philanthropic initiatives such as Elon Musk’s recent declaration that he will commit US$100 million as a prize for a demonstrable, scalable best carbon capture technology.

2) Corporate Commitment

The Science Based Targets initiative (SBTi), a partnership between the Carbon Disclosure Project, the United Nations Global Compact, the World Resources Institute (WRI) and the World Wide Fund for Nature (WWF), released their 2021 report in January. They reported that 338 large companies from whom they received emissions data collectively reduced their emissions by 25 percent for the period 2015 through 2019.

The University of North Carolina-based Data-Driven EnviroLab reported there has been a three-fold increase in the number of companies committed to net zero, from 500 recorded in 2019 to 1,541 in 2020. But to fulfil these commitments, companies will require deep decarbonization efforts, with residual emissions balanced by investment in carbon removal activities. Commitments will require ongoing financial investment in technology and operations.

3) Sustainable Green Financing

Climate change is a financial disruptor yet private Green Financing initiatives continue to emerge and grow. For example, Cambridge, Massachusetts, USA-based Prime Coalition, a public charity that partners with mission-aligned investors to support extraordinary companies that combat climate change, have a high likelihood of achieving commercial success and would otherwise have a difficult time raising adequate financial support to scale. Another example is Fifth Wall, a VC company that specializes in real estate and climate tech and is raising US$200 million for a new Climate Impact fund.

Existing major financial institutions are funding carbon-cutting startups as well as ridding their investment portfolios of carbon intensive companies. JPMorgan Chase, for example, announced financial commitments aligned to the objectives of the Paris Agreement. They also set a goal to finance US$2.5 trillion in sustainable investment funding by 2030. Citigroup likewise committed US$1 trillion to climate change/sustainability investments. BlackRock and Temasek set up a new company, Decarbonization Partners, to finance companies that reduce reliance on fossil fuels and reach zero-carbon emissions by 2050. Finally, the Bank of America and HSBC both indicated that they plan to phase out all greenhouse gas emissions from their operations and supply chains by 2050. Major banks will therefore play a major role in combating climate change if they can overcome the barriers raised by U.S. legislatures and the courts.

Green financing from the U.S. Government takes many shapes and forms, including the president’s infrastructure plan and green stimulus goals. His stimulus proposal calls for spending trillions of dollars and has clean energy at the core of the program. The money proposed includes grants, loans and tax incentives to support clean energy, energy efficiency and electric vehicle programs.

The proposed stimulus plan has two primary goals: fighting climate change and re-energizing the economy. This dual approach assumes that the economy and sustainability initiatives are inextricably intertwined. To realize these goals, the administration’s plan focuses on building a renewable-energy infrastructure greatly expanding the technologies to support a more powerful and resilient power grid, retrofitting buildings to be more energy efficient and resilient, and eliminating carbon from major greenhouse gas-emitting industries. Additionally, there are several initiatives to support the production of electric cars, such as the provision of permanent tax credits for electric utilities that generate zero-carbon electricity. Another such initiative will subsidize the current cost of electric car and truck batteries to make such vehicles competitive with fossil fuel vehicles. The stimulus plan also calls for the construction of more than 500,000 electric charging stations in the U.S.

Existing programs provide a variety of loans or grants that are provided and administered by government organizations such as the Small Business Administration and the EPA.

4) Focus on High-impact Sectors

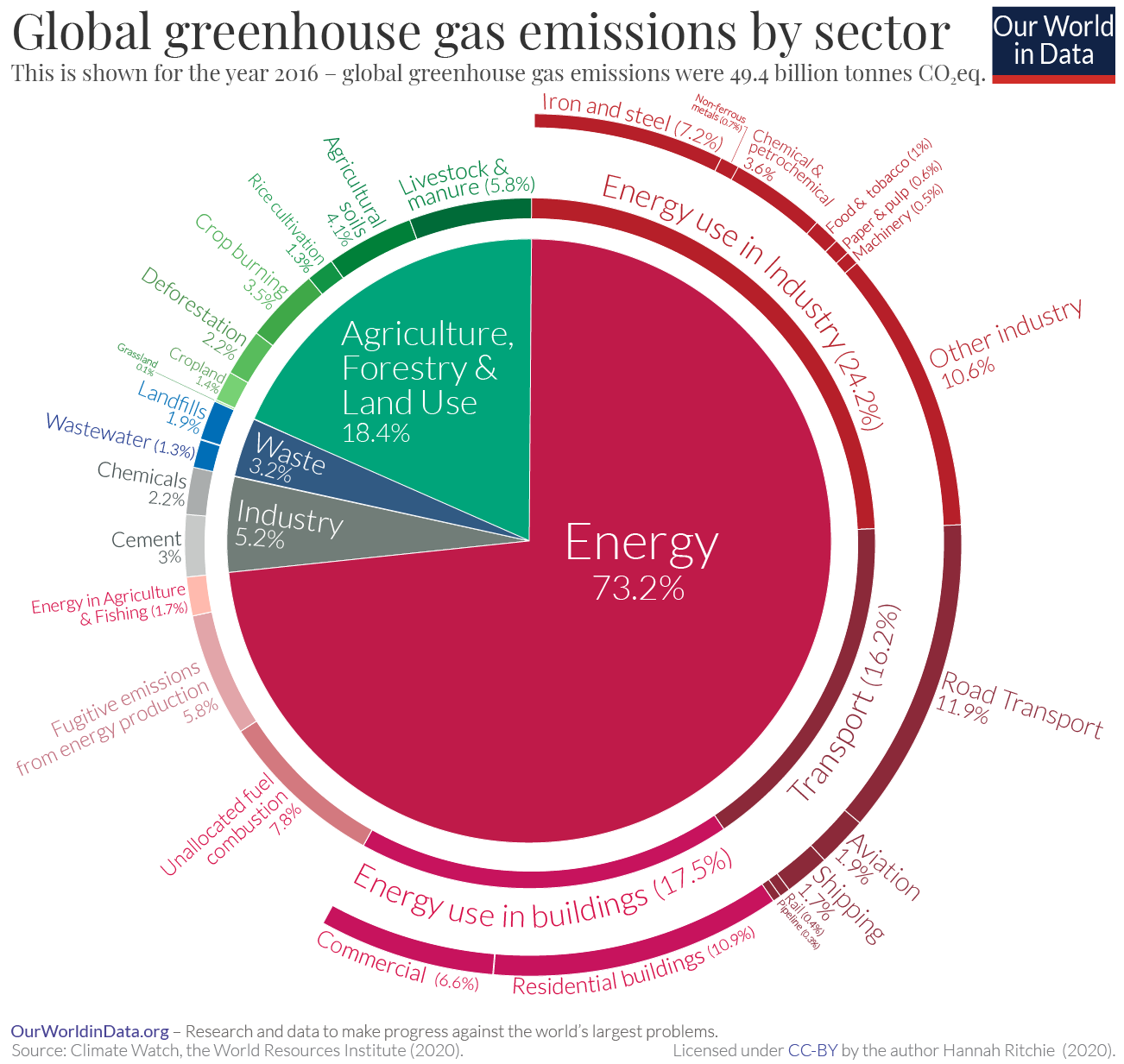

OurWorldData.org maintains that energy use accounts for more than 73 percent of global gas emissions. This number includes 17.5 percent that comes from energy use in buildings and an additional 16.2 percent that comes from transportation.

5) Partnerships Between Cities and Building Owners

The C40 Cities Climate Leadership Group is a network of 97 of the world’s megacities that are committed to addressing climate change. According to Forbes magazine, “C40 supports cities to collaborate effectively, share knowledge and drive meaningful, measurable and sustainable action on climate change. According to C40, buildings account for roughly 50 percent of a city’s total carbon emissions and 70 percent in major cities like London and Los Angeles.”

The UN Environmental Program reports that the buildings sector has one of the highest carbon footprints, currently contributing 30 percent of annual global greenhouse gas (GHG) emissions and consuming around 40 percent of the world’s energy. Commitments made within the Paris Agreement call for cutting 77 percent of CO2 emissions currently produced in the buildings sector by the year 2050.

There is also a great deal of work going on in the U.S. with local governments adopting climate action and resilience plans to focus on adaptation and mitigation strategies that focus on public/private partnerships.

6) Improvement of the U.S. Energy Grid

As reported by Michael Jung, Policy Director for Silver Spring Networks for EnergyCentral.com, the U.S. Energy Grid can support climate change improvements through investments in:

- Improving energy conservation by providing real-time feedback on energy usage and communicating time-sensitive price information to customers;

- Increasing grid efficiency through grid optimization;

- Achieving renewable energy integration and intelligent alignment of the grid’s energy demand with supply from renewables.

- Transporting electrification including electric vehicles powered by renewables. Utilities also have a role to play through providing incentives to charge electric vehicles during off-peak periods.

7) Research and Technology Optimization

This can take place at several levels including:

Infrastructure

Perhaps the most promising technology related to environmentally and financially sustainable carbon storage today relates to carbon capture – taking back CO2 from the air and storing the carbon so that it cannot reenter the atmosphere. Climate capture and storage (CCS) is the essential technology required if we are to meet climate change goals and targets. The extracted carbon is stored primarily in underground geological formations. To date, there are more than 200 CCS facilities globally under development or operational, and it has been estimated by the U.S. National Energy Technology Laboratory that North America can store more than 900 years’ worth of CO2 at 2019 production rates.

What is new about carbon capture and storage technology is the ability to prove that storage of carbon in many types of geological formations is effective (i.e., will not leak) well beyond the time that carbon can impact climate change; and the probability that it will soon be possible to capture post-combustion CO2 cost effectively, which means that fossil fuel power plants and other large CO2 emitting companies could be retrofitted with CCS technology.

Renewables

There will be two break-out technologies that should make green financing investments successful: wind power and battery storage capacity.

Wind Technology

The U.S. Government loan guarantee program has set aside $2 billion with a plan eventually to install 30,000 offshore turbines by 2030. The first scheduled offshore wind farm, to be located over 10 miles off the coast of Massachusetts, will install 84 wind turbines by 2023. Carbon emissions will be reduced by over 1.6 million tons per year. This renewable source of energy represents approximately 20 percent of the electricity consumed by the state.

Energy from wind turbines is vastly expanding globally. Europe has used this technology for years and already has more than 75 wind farms in 11 countries with 2,500 turbines and a combined capacity of more than 8,000 megawatts installed and connected to electrics grids.

Battery Storage Capacity and the Electric Grid

Batteries and electricity storage are receiving a great deal of attention as most automakers have made major commitments to electrifying their car production lines. Batteries are responsible for one-third the cost of electric cars. The transition will be accelerated by an infrastructure bill that proposes US$174 billion to encourage Americans to drive electric cars and trucks. This in turn has generated hundreds of battery start-ups to examine and improve the primary characteristics of current-generation lithium-ion technology: cost, speed of charging, number of charge-discharge cycles, the amount of energy that is contained and safety to operate. Although the lithium battery has undergone improvements, much attention has been given to solid state batteries, which can improve the energy capacity by 50 percent as well as charging speed and safety.

As the demand for energy increases, more fossil fuel utilities will turn to high-capacity batteries to meet the demand. Researchers are already experimenting with grid-scale batteries using renewable power sources including solar and wind farms. It will be possible to generate and store electricity during the day and then make it available at lower cost during off-peak periods.

Summary & Recommendations

As countries and economies recover from COVID-19, there is a unique opportunity to focus recovery measures that are compatible with climate goals. This includes a coordinated approach by governments and businesses to leverage evidence-based research and scientific fact to establish incentives, policies and investments that focus on commonly agreed-upon goals. Opportunities to lead by example are readily available for both the public and private sectors. Many governments have taken this step with a financial and sustainable climate change commitment at the federal government level – such as the U.S. infrastructure/climate plan and the country rejoining the Paris Agreement.

The government must expand its vision to provide support for companies that declare not only that they are going to reduce their carbon emissions, but that they will put the necessary actions in place to achieve realistic goals and report regularly on their progress toward those goals. It will also require that the government monitor industries to reduce greenwash. Because buildings account for such a large part of total energy consumption, building owners and operators have a major opportunity to make a positive impact on the climate.

There are a few examples of countries that have successfully planned and implemented climate change activities. Germany has had to balance a number of competing economic and political factors to get to its current level of successful clean energy. As stated by ForeignPolicy.com, Germany’s level of energy maturity is the result of several factors:

- Adding clean energy capacity over the last two decades;

- Encouraging investment through price supports;

- Accepting financial responsibility for its energy policies; and

- Exporting surplus power to other countries

Germany has an excess of energy generated from wind, which can overwhelm its power grid. The stability of the electric grid will be further challenged as the population switches to electric vehicles. The government is aware of this issue and will make capital investments to add capabilities to the grid infrastructure. Germany has a social market economy, which combines a capitalist economic system with social policies more in keeping with a welfare state that nevertheless enables competition in the global marketplace. This is a unique set of strengths, with government, businesses and unions cooperating for the common good. When it comes to climate management and carbon emission reductions, all countries must also work for the common good.