by Brianna Crandall — November 21, 2014—New York’s Upper Fifth Avenue has overtaken Hong Kong’s Causeway Bay as the world’s most expensive shopping destination in terms of rent, according to global real estate adviser Cushman & Wakefield’s flagship retail research report Main Streets Across the World, just published at the MAPIC retail trade show in Cannes, France.

The report is widely recognized as the barometer for the global retail market and ranks the most expensive locations in the top 330 shopping destinations across 65 countries. Cushman & Wakefield monitors and analyzes the evolution of the global retail industry and its trends to ensure its clients are best positioned to capitalize on future developments in the sector.

According to the report, prime retail rents across the globe rose by an average of 2.4% in the 12 months to September 2014, with recovery being sustained but at an overall slower rate. Volatile and somewhat subdued economic activity affected some markets, while structural changes impacted others. However, despite a more constrained rental growth rate, 277 of the 330 locations surveyed were either static or increased over the year.

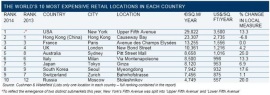

The ranking of the most expensive retail locations in each country recorded notable movements this year. Rents in New York’s Upper Fifth Avenue hit a record $3,500 per sq. ft. per year as it leapfrogged Causeway Bay, which saw rents fall by 6.8%, to secure the top spot.

Despite seeing no change to rental values after a 40% rise last year, Champs-élysées in Paris retained its third place, which was followed by London’s New Bond Street in fourth, where rents rose by 4.2%. Pitt Street Mall in Sydney completed the top five, with the location surging up three places as it recorded an increase of 25% on the back of a several international retailers taking up large units in the last six months.

The Americas yet again led the way as prime rental values surged ahead by 5.8%, an identical rate to that recorded in 2012/2013. The United States and Mexico were the main catalysts behind this expansion, while Brazil reportedly acted as a drag on growth.

Cushman & Wakefield’s global retail COO and head of retail in the Americas, Matt Winn, commented, “Positive economic news, combined with healthy retailer fundamentals, continued to filter through into the U.S. retail market. Prime rents over the year to September were up an impressive 10.6% on the same period last year. Indeed, strong retailer demand and robust tourist numbers continued to support expansions across the country, with gateway cities such a Los Angeles, San Francisco and New York in particular witnessing double-digit growth. The arrival of brands such as Microsoft, which recently announced its first flagship store in New York’s Upper Fifth Avenue, further underlined the importance of these premier shopping destinations.”

A slower expansion was also evident in Asia Pacific (3.6%) where the traditionally buoyant Hong Kong market was adversely affected by a decline in retail spending and lower tourism growth.

Occupier conditions in the Europe/Middle East/Asia (EMEA) region were generally firmer and improved, evidenced by a stabilization in markets previously witnessing marked declines in rents. However, EMEA growth (1.3%) was held back by significant falls in the Middle East. Indeed, prime rental growth in Europe (2.3%) was not too dissimilar to 2012/2013.

The report ranks the most expensive locations in the top 330 shopping destinations across 65 countries.

The report ranks the most expensive locations in the top 330 shopping destinations across 65 countries.(Click on image to enlarge)

Martin Mahmuti, a senior investment analyst at Cushman & Wakefield, concluded, “The trend for major retail brands to experiment with design, layout, content and services, as they reinvent the concept of their flagship stores, is continuing to impact on major gateway city markets and will remain a key factor influencing growth in the year ahead. Despite the still uncertain economic situation in some parts of the world, notably in Asia Pacific and the Eurozone, retail market activity is expected to improve in the year ahead. Premier shopping locations will remain in high demand as retailers are keen to establish a presence and raise their brand profile, but supply as ever will remain tight. The growth of online shopping, supporting the polarization [of”> the market in favor of the biggest and the best, will increasingly drive retailer expansion strategies whilst also having a structural impact on local markets.”

For further detail about specific markets and regions, see the full report, Main Streets Across the World, on the Cushman & Wakefield Web site.