With 2010 just around the corner, many of you are likely wondering how close were the predictions on organization and strategic emphasis from CoRE 2010?

In conjunction with CoreNet Global, Deloitte Consulting recently conducted a survey of leading organizations to better understand how CRE and Workplace (CRE/W) functions operate in today’s business environment. Sixty senior CRE and Workplace executives participated in the survey, each representing the highest level or most senior CRE/W executive from each company. Based on this survey, it is evident that change continues to be a reality for CRE/W groups across the represented industries and organizations. More than 65 percent of the surveyed companies have undergone organizational change within the past five years, and many within the past 2-3 years. Interestingly enough, only 29 percent of the organizations surveyed had not restructured within the past five years.

As an enabling function, CRE/W groups do not change for the sake of change. Many of these changes may be attributed to a range of causes, including shifts in the overall business model, operating processes, or supply chain activity driven by core business functions. As CRE/W organizations endeavor to keep pace with these changes, one wonders “How did we do?” and “What is next?”

How Did We Do?

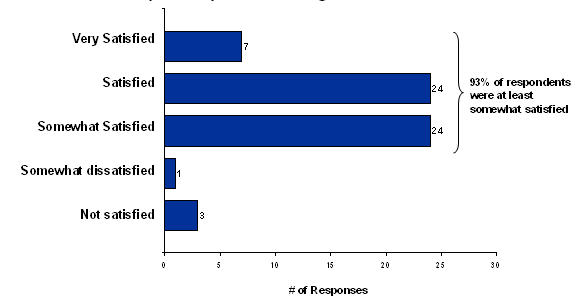

Despite the changes, a majority (93 percent) of the respondents indicated that they were at least “somewhat satisfied” with their current organizational structure. Only about 12 percent indicated that they were “very satisfied.” Approximately 7 percent of the respondents clearly indicated that they were “somewhat dissatisfied” or “not satisfied” with their current organizational structure. One could certainly interpret the 41 percent of respondents that were “somewhat satisfied” with the current structure as an indication that while changes may have been directionally correct, further refinement may be required (see Figure 1).

While one could argue that a different structure exists for every CRE/W organization found across industry, the various structures can be categorized into a limited number of operating models. The most prevalent operating models include: the Direct or Center-Led Model, the Indirect or Advisory Model, and the Influence Model.

- Direct or Center-Led Model — In this model, all CRE/W employees within an organization report up through a single, global lead. The model is described as “fully integrated”, as there is a single CRE function for the entire organization. Regardless of geography or capability area, CRE is structured as a centralized organization and drives strategy, policy, process, technology, and performance management in a standardized manner globally. Lastly, customer relationship management and supplier/vendor management is centrally coordinated.

Figure 1: How satisfied are you with your current organizational structure? - Indirect or Advisory Model — With the indirect or advisory model, a portion of the CRE/W function is centralized and reports directly into a global lead. Additional CRE/W employees are aligned by business unit and/or by geography and report into local business operations/management. The functional or geographically aligned staffs typically have a dotted-line relationship to the Global Lead for CRE/W, driving the “indirect” nomenclature. CRE drives strategy, policy, process, technology, and performance management from a centralized organization, but adoption of these standards by the field is voluntary.

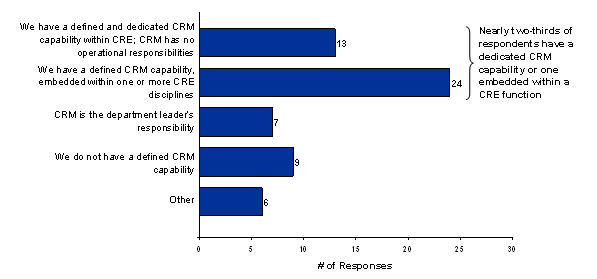

Figure 2: How would you describe Customer Relationship Management (CRM) for the corporate real estate (CRE) function at your corporation? - Influence Model — This model provides for a small, “center of excellence” that provides CRE advisory services to the organization’s various business units. In this model, the CRE group does not control the resources that execute the work, as these resources are aligned to local business unit operations. The business units are typically not required to leverage the knowledge or expertise of the CRE group, but certainly encouraged to. Of the three models presented, the “influence” model presents the most challenges relative to the development and implementation of strategy, policy, process, technology, and performance management in a standardized manner globally.

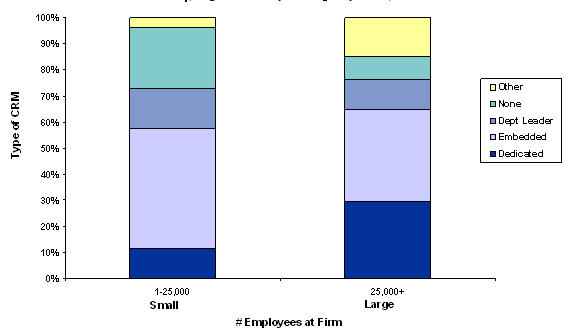

Figure 3: How would you describe Customer Relationship Management (CRM) for the corporate real estate (CRE) function at your corporation? (Segmented by Company Size)

The decision to adopt a particular type of operating model and organizational structure is dependent on several contributing factors, including: (1) the maturity of the CRE/W group, (2) the complexity of overall enterprise, (3) the industry context (i.e. Financial Services versus High Technology), (4) the scope of services, (5) the geographic distribution of operations, and (6) the chosen service delivery model (i.e. outsourced, out-tasked, in-house, or hybrid delivery).

The Good, the Bad, and the Functional

In recent years, many CRE/W groups strived to align with their business customers and as a result, implemented some variant of the three operating models described above. The question is “How well are these models working?” and “Which models work best in specific situations?”

While every CRE/W group may want to be a “strategic partner” to the business, to do so requires the overall enterprise to be enlightened to the benefits of effective asset management and the CRE/W group to be effectively delivering the across the entire value spectrum, from facilities operations to long-term portfolio planning. Some would argue that the direct or center-led model best supports the delivery of services across a wide geographic area.

|

|

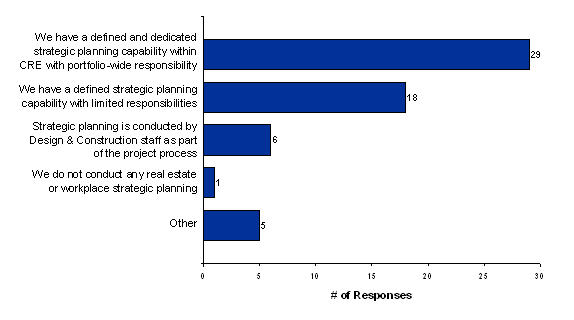

| Figure 4: Which statement best describes real estate or workplace strategic planning activities at your organization? |

As CRE/W groups and their companies evolve and better appreciate the benefits of effective asset planning and management, groups typically trend towards a direct or center-led model. Over time, the direct model supports easier transition to the highly outsourced service delivery models that many companies are pursuing across shared services, including corporate real estate/workplace planning and management.

At the other end of the spectrum, groups that are primarily focused on facilities operations and the delivery of tactical services often operate more effectively in a decentralized model that leverages the independence of individual locations to address customer needs/requirements. In this organizational context, the mere discussion of a direct or center-led model drives fear and resistance into the minds of the stakeholders. While there is no “one size fits all” model, the various capabilities within each model (i.e. customer relationship management, strategic real estate planning, project management, facilities management, etc.) must be effectively deployed in light of the industry environment, company culture, and CRE/W maturity.

For example, while customer relationship management (CRM) is now recognized as a formal capability area within corporate real estate, the approach to CRM deployment varies dramatically across industries and operating model. Typically, successful CRE CRM deployments have involved centralized groups that leverage a direct or center-led operating model. In these situations, the CRM capability benefits from the overall governance program and infrastructure. This approach works well in organizations that are globally aligned by function and deploy a shared service model. In these situations, CRE/W groups can often implement a CRM program that uses full-time customer relationship managers to build strategic relationships with business leaders and engender an asset management culture. Without this centralized approach to global business management, it is often more effective to deploy the CRM capability as a collateral duty associated with one of the other core CRE capabilities, such as Real Estate Transaction Management or Project Management. In a decentralized environment, the transaction and project managers tend to establish strong ties with business unit stakeholders and are well positioned to support CRM activity.

In the end, one would be hard pressed to say which model is the “best” or which model better supports the various CRE/W capability areas. As each organization is different and operates within a specific industry context, the “right” model for any given organization will be somewhat unique, but still aligned with one of the three operating model descriptions highlighted above.

What’s Next?

To give a view into “what’s next”, the following are vignettes of key trends on a variety of CRE/W organization topics which demonstrate the organizational emphasis by leading companies. The following vignettes highlight the key survey findings and present viewpoints on the topic for you to consider (see Figure 2).

Customer relationship management began in retail or sales and has over time trickled down to the real estate, facilities and workplace community. Some companies explicitly acknowledge the need for customer relationship management, while others ponder on the cost versus benefits. While many companies have instituted some form of CRE/W CRM (63 percent), only 22 percent have dedicated CRMs with no operational responsibilities. Interestingly, more than 25 percent of the survey respondents indicated that they did not have any formal CRM capability or ascribed the responsibility to the department head.

You may ask, “Aren’t we all in the service business and therefore all responsible for customer relationship management?” While this is true, a CRE/W CRM needs to operate at both tactical and strategic levels. At the tactical level, CRM is about customer service and ensuring consistent satisfaction through each transaction experience (i.e., a move, a work order, etc.). At the strategic level, CRM has the ability to elevate real estate and workplace topics to the C-suite or divisional leadership levels, by maintaining an on-going dialog with senior management and promoting the value added impact and lever that is the workplace. To operate at the strategic level requires senior individuals with deep credibility and experience to translate the issues in ways that will resonate with the C-suite and divisional leaders.

Depending on the nature and complexity of a company’s operating model, CRE/W CRM may be deployed in different ways. Leaner CRE/W organizations tend to embed the CRM function as part of an operational role, with designated CRM responsibilities (survey indicates that only 3 of 26 organizations with 25,000 or less employees have dedicated CRMs). While larger, more complex organizations may have dedicated assigned roles to single or multiple customer groups. Regardless of the structure, it is critically important to define the competencies, skill-sets that the CRM needs to possess and also the processes and activities that would be conducted on a regular basis.

In some cases, CRM is structured at the shared-services level, as part of an on-going effort to streamline administrative tasks for the front-line business groups. In the case of a centralized, shared services level CRM model, the CRE/W function will need to provide subject matter expertise and be brought to the senior management discussions for strategic advice about real estate and workplace levers, opportunities and options.

So, how do you know that CRM truly brings benefits to CRE/W management? Based on recent “Voice of the Customer” discussions, we know that customers value, to the extent possible, a single point of accountability. More often than not, the customer perspective has been “If it’s not broken, then I don’t need to deal with it. And if I need to deal with it, don’t ask me to navigate the organization of the CRE/W department. Give me one person to speak with who can answer my questions and get the work done.”

|

|

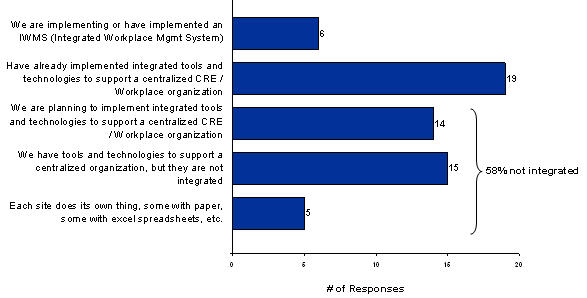

| Figure 5: How does your approach to deploying enabling tools and information technologies align with your organizational structure? |

Strategic Planning as a Discipline and Capability

Definition: Strategic planning is an organization’s process of defining its strategy, or direction, and making decisions on allocating its resources to pursue this strategy, including its capital and people (www.Wikipedia.com).

CRE/W strategic planning, similar to the above definition, is about an organization’s process of defining the strategy for real estate and workplace decisions and coordinating the allocation of staff and capital resources towards workplace programs, projects, and initiatives. Strategic planning in this context is broader than just a restacking or master-planning exercise. It is about harnessing all the data points and reviewing competing demands on a portfolio-wide basis, to yield specific programs or projects that will be funded and executed in the coming year(s).

The comprehensive data set should include site information, operational information, demand forecasting, portfolio and lease data, master planning information, capital investment constraints, tax assessment data, labor market and demographic information, subsidies and incentives, real estate market data, total cost of ownership/service, and ROI analysis. Typically, this strategic planning cycle may be a rolling 12-18 month assessment cycle that adjusts for divergent scenarios as business context and conditions change.

For some companies, growing out of the ‘bricks and mortar’ real estate, engineering and site services approach, deploying strategic real estate/workplace planning with a comprehensive portfolio-wide or global view is challenging. The latency of the industry in adopting strategic planning has much to do with the maturity of the CRE/W organizations. It is encouraging to see that nearly 50 percent of all survey respondents indicate having a defined, dedicated strategic planning capability for portfolio-wide CRE planning. As organizations move toward greater centralization and step-up the maturity curve to strategic partner and visionary status, a comprehensive assessment becomes increasingly achievable (see Figure 4).

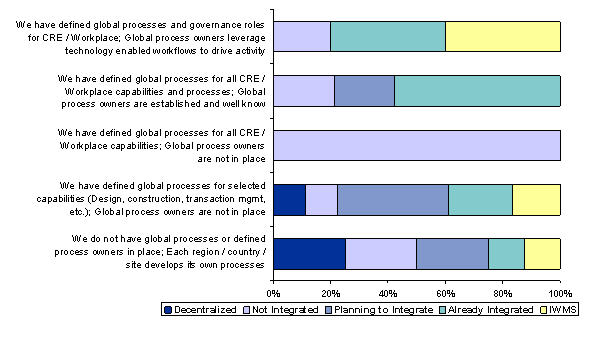

In addition to slow evolution, the industry has been data challenged until the last decade or so. In fact, 58 percent of all respondents either have a decentralized approach to managing data and related technologies or have not integrated technologies to enable decision analytics without vast amounts of prep-work.

With recent efforts by OSCRE (Open Standards Consortium for Real Estate) and the IWMS (Integrated Workplace Management Solution) proponents, true visibility into the state of enterprise assets is just becoming a reality. Many companies are still on a journey to establishing a sustainable framework for informing proper strategic planning processes and analytics through the use of technology. This journey is well under way, with 42 percent of the survey respondents having fully integrated tools and/or an IWMS in place. About 24 percent of respondents intend to integrate CRE/W technologies in the near future (see Figure 5).

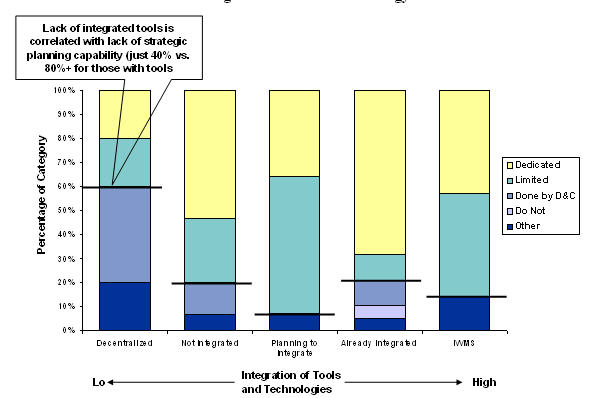

Data also indicates a high correlation of companies with a dedicated strategic planning capability being supported by centralized technologies (nearly 80 percent, whether stand-alone or integrated). Conversely, the companies with a decentralized approach to data tracking, using excel spreadsheets, paper and other methods, tend to have a lower level of strategic planning capability (see Figure 6).

|

|

| Figure 6: Are the companies with dedicated strategic planning functions supported by integrated tools and technology? |

|

|

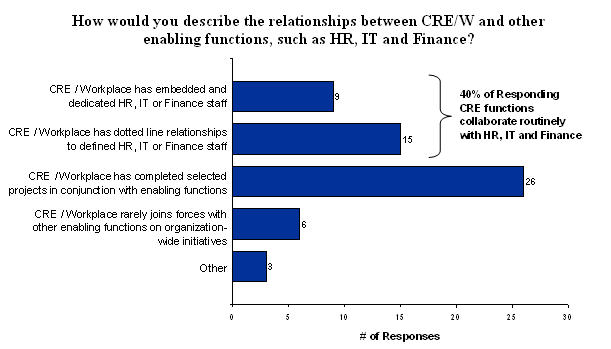

| Figure 7: How would you describe the relationships between CRE/W and other enabling functions, such as HR, IT and Finance? |

Partnering with Enabling Functions

HR, IT, CRE or Workplace and Finance have collectively been termed as the “enabling functions” by recent industry references. This category of corporate departments sets a clear distinction between the revenue generating “front of the house” and the support functions that enhance the revenue generating units’ ability to focus on their core work activities. Individually, each of the enabling functions has undergone dramatic changes over the last 30 years. With the advancements of computers, ERP systems and the internet, each enabling function has fundamentally shifted its processes and adoption of technologies. While organizational trends have recently proceeded to cluster these functions in shared services entities, many functions remain stand-alone.

Curiously, as each of these functions evolved, the main focus has always been about how best to service the business. Very rarely have these functions supported each other nor partnered on initiatives until recent workplace and integrated resource and infrastructure management trends. Anecdotal discussions with CRE/W organizations indicate that, in the past, CRE has received marginal support from the other enabling functions. This treatment stems from the perception that the only customers are the front line businesses (see Figure 7).

Recent momentum in workplace innovation, mobility, and evolving work force expectation/demands, has resulted in a tighter focus between the enabling functions. Survey findings indicate that 40 percent of the respondents routinely collaborate with the other enabling function on strategic initiatives, often through dotted-line reporting relationships.

Today, the CRE/Workplace function is driving a cross functional agenda that creates opportunities for other enabling functions. Consider that a Workplace Transformation effort requires the coordination of place (Real Estate), with tools (Mobility IT), policies/protocols, performance management, and talent implications (HR). Above all, these solutions are predicated on ROI benefits through comprehensive business cases (Finance).

So the key question to ask is: Where does my CRE/Workplace organization stand in comparison to other enabling functions within my company? Is my CRE/Workplace organization:

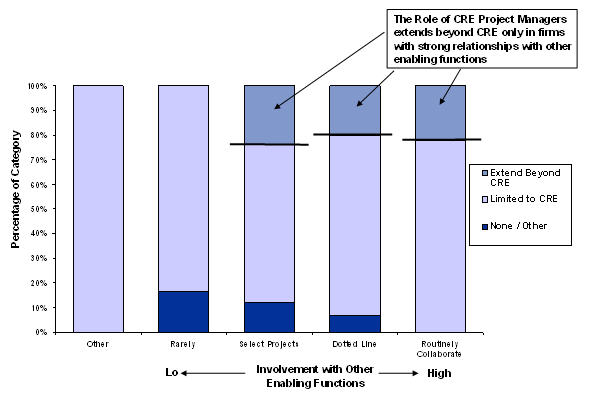

This dialog and on-going relationship with the other enabling functions is further validated by the survey data. Having close relationships with other enabling functions (partnering on selected projects, either through dotted-line reporting or routine collaborate) correlates with the CRE/W department’s ability to add program management value to projects beyond CRE/Workplace. As transactional project management within CRE/W is increasingly out-tasked and outsourced, can traditional CRE project managers “swim upstream” and manage enterprise wide programs that deliver incremental value to the company? Answering this key question is the difference between outsourcing the responsibility and creating an enterprise role that elevates the criticality of the CRE/W function (see Figure 8).

|

|

| Figure 8: Do partnerships with enabling functions equate with CRE’s ability to extend service offering into broader program management? |

Extending Project Management Skills into Program Management

During the last decade, the emphasis within the CRE/W industry has become more strategic, through organization constructs, and better leveraging data and analytics. As transactional activities continue to be out-tasked or outsourced, retained employees with great project management skill-sets are often called on to “wear different hats” or manage more strategic activities. Of the surveyed companies, 72 percent of the respondents have project managers that are still limited to traditional roles of design and construction project management, while 19 percent of the project management staff are leveraged across disciplines and geographies.

In the past, a project manager might have simply managed design and build-out activities. In today’s context, that same project manager may be asked to lead a business unit into an emerging market from the infrastructure and support perspectives, providing seamless facilitation of all the moving parts and activities. These “program managers” leverage the same problem solving skills honed over time from project-to-project. By helping to retool these project managers into “program managers” with Six Sigma or other similar training, CRE/W can help establish a true center of excellence focused on program management of operational improvement activities. These “black belt” program managers can manage any number of operational improvement projects with the same rigor applied to managing cost, time and resources, as in the past.

|

|

| Figure 9: How are global CRE/W processes developed and managed within your current organization structure? |

Establishing Global Process Roles

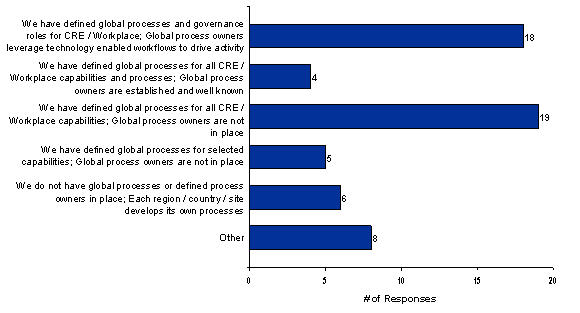

Distinct and potentially separate from the management of a CRE/W capability area (i.e. Transaction Management, Portfolio Management, etc.), global process ownership can be described as a non-operational role focused on policy definition, process development/continuous improvement, and standards delineation. In many CRE/W groups, these process responsibilities are not well managed and only addressed periodically or as required. This fragmented and distributed process approach is indicated in survey results in that nearly 60 percent of the respondents do not have CRE global process owners. In some organizations, policies and processes might not be updated or refreshed for several years, which does not support the continuous improvement mandates that you see at most companies today (see Figure 9).

By implementing global process roles for CRE/Workplace, organizations can more effectively drive standardization of process across geographies and enable consistent local delivery capabilities. Forward thinking CRE/W organizations will often establish global process roles for strategic planning, transaction management, project management, and facilities management. These process roles can provide growth and leadership opportunities for practitioners that may not yet be in management positions.

As the activities associated with a global process role are typically collateral (part-time) duties, the individuals that serve in a global process role capacity are often dedicated to some aspect of day-to-day CRE/W operations. For example, a Regional Lead for Real Estate & Facilities may also be a global process owner for real estate transaction management. In another example, the Director of Capital Projects may also be the global process owner for project management.

As CRE/W groups begin to better leverage information technology through the use of integrated workplace management solutions (IWMS), the importance of global process roles will only increase. As processes are technology-enabled and CRE/W groups seek to drive increased efficiency from existing resources, process owner roles will ensure that organizations leverage leading practices and focus on continuous improvement (see Figure 10).

|

|

| Figure 10: Are companies with global process considerations more likely to have deployed integrated tools and technologies? |

Better Leveraging Service Delivery Models

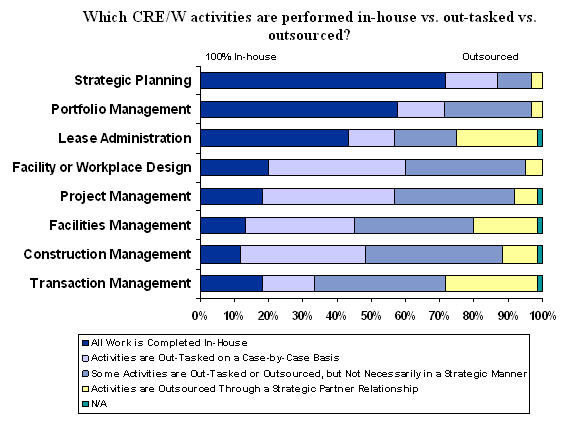

Over the past several decades, CRE/W groups have leveraged a wide variety of service delivery models. Influenced by management fads, economic conditions, and corporate culture, the tendency to use internal vs. external resources has changed over the years. In reviewing the state-of-the-market, it is clear that CRE/W organizations have migrated to more highly leveraged models, outsourcing large portions of the day-to-day tactical operations work to external service providers. This trend continues in a predictable pattern, in that strategic planning, portfolio management and lease administration continue to be managed mostly in-house, while transaction and site services related activities are out-tasked or outsourced to an external service provider (see Figure 11).

In years past, organizations leveraged service delivery models that fully relied on internal resources. As the use of external resources to support service delivery became more common place, corporate-to-service provider interactions transitioned from vendor agreements, to preferred supplier agreements, to strategic alliance relationships, and most recently to strategic partnerships, the nature of the relationships became more complex, strategic, and focused on the long-term.

In some cases, CRE/W groups within large global organizations have proceeded down the path to outsourcing a large portion of CRE operations, only to eventually revert back to an “in-sourced” model due to a less than satisfactory experience with a highly leveraged strategic alliance or partnership. In some of these situations, the CRE/W group was not sufficiently mature in its structure and processes to effectively leverage a strategic partner relationship. In other cases, the external service provider was not sufficiently sophisticated or evolved to meet the expectations of the CRE/W group.

Regardless of the reason, for every successful corporate real estate services sourcing strategy there is a partial or complete failure. The personal and professional relationship established between service providers and corporate support functions are critical to the success of any sourcing model. In fact, many would argue that the success of a real estate services outsourcing effort can be determined by the success of the often overlooked transition period.

|

|

| Figure 11: Which CRE/W activities are performed in-house vs. out-tasked vs. outsourced? |

The Wrap-Up

These vignettes on organizational design considerations are meant to provide some food for thought and allow you to baseline where your organization currently stands. While not every concept is appropriate for every company, the critical common link between all these vignettes has to do with managing across the silos that often exist in CRE/W organizations. Customer experiences often “hang in the grey space” and there is a fine line between providing a great customer service experience or a generating a series of lasting complaints.

At the end of the day, no organizational construct is exactly the same, but CRE/W groups should think through each model/option and solve for the one that is uniquely fit to your company and industry. As your organization operates in a more strategic manner, CRE performance management will become a reality and necessity, as opposed to just a vision.

CRE/W organizations already understand their impact relative to cost management and cost reduction. As organizations evolve and better appreciate the potential impact of CRE/W relative to strategic planning, sustainability, and innovation, the CRE/W agenda will continue to migrate from being a topic of discussion in the boiler room to a key agenda item in the boardroom.

For more information on this topic, go to CoreNet Global’s Knowledge Center Online.

CRE Trends in Organization Structure

Designing the Optimal Corporate Real Estate Organization

About the Authors:

George Bouri, MCR, SLCR, is National Practice Leader, Capital and Real Estate Transformation and Principal, Deloitte Consulting, LLP.

Francisco J. Acoba, MCR, SLCR, is Capital and Real Estate Transformation Senior Manager, Deloitte Consulting, LLP.

Pay Wu is Capital and Real Estate Transformation Senior Manager, Deloitte Consulting, LLP.