The Lifecycle Approach

Lifecycle isn’t just about when to replace a particular piece of equipment or building component, it’s about taking a systematic approach to balancing maintenance costs, operating costs and replacement/refurbishment costs over the life of the asset. While it may seem complicated, in practical application, it is very simple. The benefit of using Lifecycle Costing (LCC) is that it combines cost information with your hands-on experience and provides you with a reason to take a closer look at some of your costs, which you can work towards reducing. It also gives you financial information you can use to make decisions.

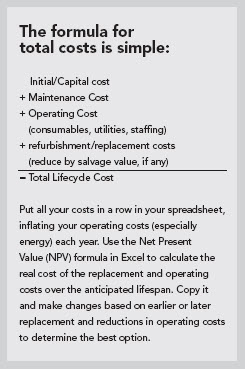

The concept is simple — Lifecycle Costs include all costs associated with building assets from acquisition to disposal/replacement of the building itself. For practical reasons, a typical lifespan is often used, such as 30 years or 50 years, depending on your organization and the type of facilities you own. For costs that are in future years, adjust upwards for inflation each year and then adjust downwards for the real value of money in that year compared to today’s money. It’s easy to do with Excel’s built-in formulas.

What does this mean for you?

Initial costs of a building represent only 10-20 percent of total cost, depending on the life span you assume for the building. Privately owned buildings have a shorter lifespan while government and institutions have a longer lifespan. The rest of the cost, an astounding 80-90 percent, is for maintenance, operating and refurbishment/ replacement of components over the building lifespan. Ignoring this large proportion of costs means you may be wasting money.

How can you use Lifecycle Costing for new facilities?

While minimising the initial capital cost of your building seems right, it could cost you a lot more over the life of the building. The initial capital cost is the most visible and easily measured part of the decision making process, yet the high cost of bad decisions is only seen in the future. Justification and decisions should be based on the total cost of ownership, not just initial costs.

Implement techniques that drive down the total cost. Use effective financial analysis to illustrate the benefits and shift the behaviour of decision makers. By estimating the total cost of operating over the life of the facility based on a more efficient design and by using this information as part of the budgeting and decision making process, you will arrive at a better decision — one that may include higher costs to design and build a more efficient building or to purchase more expensive yet energy efficient and longer lasting components.

The easiest way to reduce total costs is to build operating efficiency into the design and construction of the building using existing techniques, many of which are well developed but not always used. Here are the most useful:

- Green initiatives:

Use green standards and initiatives to lower ongoing energy costs. This includes how the facility is designed and the energy efficiency of the equipment. It’s politically and socially correct while contributing to a lower total cost of ownership. - Facility operations input in design:

Involve facilities staff and service providers such as custodial, grounds, mechanical/electrical service contractors to provide guidance on design to minimise operational costs. - Value engineering:

Value engineering goes beyond financial analysis and assesses the design, including materials, equipment and functional requirements to eliminate or modify design elements and reduce unnecessary costs. - Commissioning:

Commissioning ensures the building is performing as it was designed, meets specifications and the effort you put into the design to reduce costs will be realised.

How can you reduce operating costs at your current facilities with Lifecycle Costing?

|

|

Your existing facility has both an operating budget and a capital replacement budget. You can manage down these costs with a lifecycle costing approach, which could include either extending or advancing their replacement based on the information you collect. The best part of the process is it forces you to understand your current operational costs and the alternatives. The most important thing is to understand the costs of your major systems. This includes regular servicing and preventive maintenance, ongoing repairs, consumables and energy costs. With the right software or for smaller portfolios, an up-to-date spreadsheet, you can have the information you need. Secondly, you need to have information on the condition of your equipment, which is closely related to reliability, maintenance/repair costs and energy consumption, not to mention the required replacement timeframe.

Since LCC includes operating costs, look closely at your maintenance schedules related to your repairs and the risk of failure of that equipment. In a portfolio, if you are doing the same routines at the same frequencies on all your equipment yet they are operating in different conditions, look closer and adjust frequencies for conditions to reduce costs. A chiller operating in a constantly hot, humid city will require different routines and frequencies than one operating only during the summer season. If you are changing HVAC filters based on the calendar instead of pressure drop, get feedback on the condition of the filters when they are changed and extend filter changes based on conditions.

With your maintenance costs under control, look at your older equipment and using LCC, estimate your current costs, replacement costs and timeframes. Redo the assessment with earlier replacement that includes lower operating costs, including energy, and make decisions based on that information. Analyse the replacement and what the reduced operating costs, particularly energy, would be over the life of that equipment or your specific planning horizon versus the current equipment. This will tell you whether you will get the lowest total cost from replacing it sooner, or whether it can run well past its theoretical life, saving you the cost of replacement.

In some cases, even if the equipment can last longer, it is prudent to replace it sooner in order to reduce operating costs. Equipment that consumes a lot of energy is a particularly good target for this. Using the Lifecycle Costing approach will not only provide you with the financial information you need for an informed decision, it makes you look at all your costs much more closely to reduce both current and future expenses.

Michel Theriault is Strategic Advisor at Facility, Property and Asset Management Consulting.